Subtitle: The importance of the profit formula is not only crucial in every part of the “real” economy but also crucial for blockchains and other Web3 economies.

The concept that blockchains are exempt from the fundamental principle of economics, represented by the formula

Total Profit = Total Revenue – Total Expenses

is a widely held misconception. This is due in part to the relatively new and complex nature of blockchain technology, leading to a lack of understanding of its underlying economic model. However, it is important to note that the profit formula applies to blockchains just as it does to any other entity, including companies, countries, households, and even non-profit organizations.

This article examines the critical importance of the profit formula to blockchains. By diving into the economics of blockchains and analyzing the factors that determine profitability, this article also aims to shed light on the fate of blockchains that remain unprofitable in the future.

Generating revenue through transaction fees

It is important to understand that a blockchain is not a single entity, so as not to get confused about who receives the generated revenue. It’s a network of independent nodes (computers owned by entities) that validate transactions and secure the network. In exchange for the services performed by the nodes, users pay a transaction fee, commonly known as a “gas fee”, in the blockchain’s native currency, which is distributed among the validators who perform the work necessary. Further down in the article, this is referred to as the “real yield”. The exact method of how the fees are used to reward validators can vary depending on the blockchain’s design.

For example, in Ethereum’s case, users pay a base fee that is influenced by network usage and users additionally have the option to pay a priority fee to expedite their transaction. Remember that both the base- and priority fees are denominated in Ethereum’s native currency Ether, or in short, ETH. The base fee is burned, reducing the token supply and potentially increasing ETH’s value, while priority fees are distributed directly to validators. This model, where the network generates revenue from transaction fees, is a fundamental aspect of the economics of blockchains. How the revenue is distributed to the participants, meaning in form of direct transfers or burning mechanisms, is rather secondary.

Subsidies to become a node operator

Blockchains that use the Proof-of-Work (PoW) consensus mechanism require significant computational power and thus, require node operators to invest in specialized hardware. To reward these node operators, they are not only compensated with transaction fees but also with newly issued tokens. These incentives, or “subsidies”, serve to attract new node operators to the network and keep existing ones serving the network as the fees generated alone would not cover their expenses, making participation economically unattractive. Now the “total yield” can be calculated by simply adding the subsidies a node receives to the transaction fees a node earns.

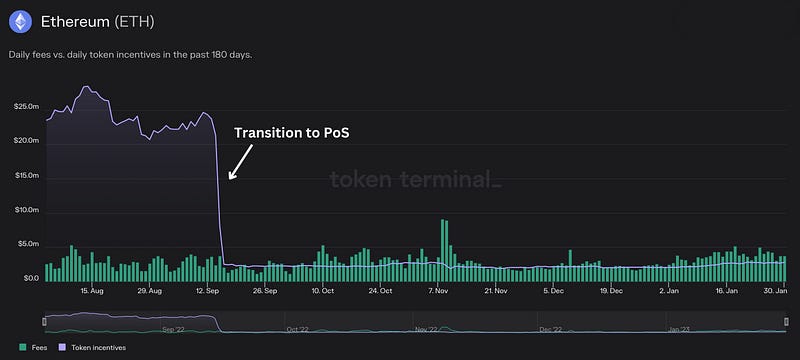

It’s important to say, that not only PoW blockchains pay such incentives to compensate the costs of node operators. It’s also for many PoS (Proof-of-Stake) blockchains common to pay such incentives as a means to bootstrap adoption. With the transition from PoW to PoS, Ethereum reduced its issuance by nearly 90%, argumenting that “operating a validating node is not as economically intense and thus does not require or warrant as high a reward.” (Source).

The supply shock can also be clearly seen in the following chart:

Understanding the role of the maximum supply

The max supply is — as the name suggests — the maximum amount of tokens that can be in circulation at one point in time. Using the max supply allows investors to calculate the fully diluted valuation of the network. The max supply is often used to promote the scarcity of tokens — mostly used by projects that don’t have a convincing value proposition to drive the demand for the token.

The question is, in what relation stands the maximum supply with the profitability?

If a blockchain network is (still) unprofitable at the point when it reaches the max token supply, the network is doomed to fail or at least doomed to lose a significant share of the market. That’s because there are no tokens left to subsidize nodes that do the work necessary to run and secure the network. With that, the real yield from transaction fees might stay the same, but the total yield is shrinking and therefore is participation less profitable for nodes. The consequence of this is that nodes search for more profitable opportunities and may leave the network.

But it should not be taken as a guarantee that any blockchain network without a max supply could be more successful. It’s just as inflation works: If the European Central Bank decides to lower the interest rates, and with that supplies the market with new Euros, the value of each Euro is decreasing. And if a blockchain network continuously has to subsidize nodes (by inflating the market with more tokens) to participate in the network, the value of the token would most likely decrease over the long term.

Only two blockchains are profitable

After getting a broad understanding of the revenues and expenses a blockchain network has, it’s time to figure out if major blockchains are profitable or not:

As can be seen in the table, there are currently only two profitable blockchains, Ethereum and Binance Smart Chain, where their generated network fees exceed their incentives paid out. For the remaining unprofitable blockchains, it is likely that their tokens will experience a decrease in value due to persistent inflation. If these networks decide to reduce their incentives to combat inflation, they may experience a loss of market share. While the market is currently fueled by expectations and speculation, a significant correction is anticipated in the future if the unprofitable blockchains are unable to achieve profitability.

Conclusion

It is important to recognize that the fundamental economic principle of Profit = Total Revenue — Total Expenses applies to blockchains just as it does to any other business or entity. For blockchains, revenue is generated through transaction fees and subsidies paid out to node operators to incentivize adoption. The presence of subsidies, rather than a blockchain’s maximum token supply, plays a crucial role in determining its profitability. Blockchains that are unable to remain profitable upon reaching their maximum token supply are likely to fail or lose significant market share, as they will be unable to subsidize the nodes necessary to maintain the network. Similarly, blockchains without a maximum token supply that continue to be unprofitable but still pay subsidies are also at risk of failure, as their native currency will lose value over time. Currently, Ethereum and Binance Smart Chain are the only profitable blockchains due to their generated network fees and token incentives. The blockchain landscape is still fueled by expectations and speculation, so it will be interesting to observe how it evolves in the years ahead.

Please note that this article has been originally posted by our Co-Founder Lukas on his Substack, accessible via this link.